What Is The Average Price Of A New Car In 2024?

According to Kelley Blue Book, new car prices are 3.5% lower at the beginning of 2024 than the same time in 2023. Yet, that's little comfort to car shoppers because even with the recent downtick, prices are still 16% higher than January 2021, when the nation was still gripped by the COVID-19 pandemic. Additionally, while supply chain restrictions and the pressure of inflation on new vehicle prices seems to have stabilized for now, the relief could be short-lived. That's because the effects of the United Auto Workers strike last fall, and subsequent pay hikes at Ford, General Motors, and Stellantis, may not be fully realized yet.

Putting aside future speculation for now, the average price of a new car at the time of writing is a whopping $47,401, once again per KBB. However, that number doesn't tell the whole story because prices fluctuate considerably by automaker, as well as when you remove luxury vehicles from the new-car equation. Further, electric vehicle prices are often dissimilar to their internal-combustion-engine counterparts.

Some car segments are weaker than others

To begin, the average price of a luxury car in January 2024 was $60,978, representing a 2.1% drop year-over-year. That's great news if you happen to be in the market for a new, upscale vehicle, which accounts for about 20% of all new car sales.

Car buyers who are ready to go green by joining the electric-vehicle revolution will find an even larger price drop of 10.8% from January 2023, which translates to an average price of $55,353 for a new EV. In particular, EV pioneer Tesla has been reducing prices aggressively to stay competitive against rival EV makers. Consequently, its new vehicles are down almost 21% year-over-year.

Note that the average price of a new EV doesn't take into account any local, state, or federal tax incentives that may be available to purchasers. If you're wondering, electric vehicles comprised 7.6% of all new vehicles sold in 2023, an improvement over the 5.9% market share in 2022.

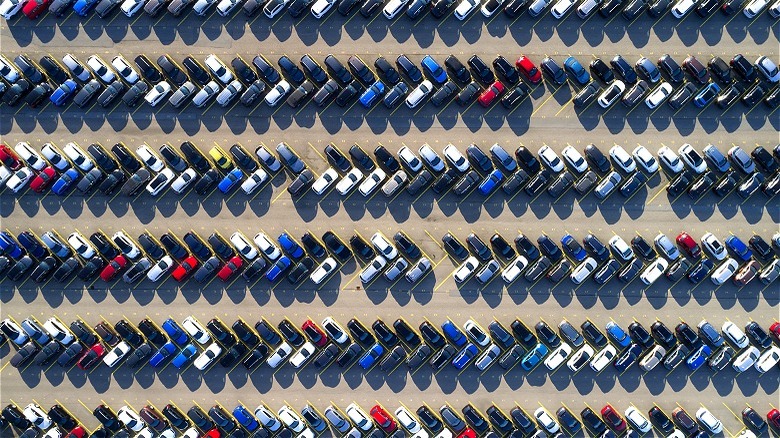

Car inventory levels are returning to normal

The number of new vehicles a car dealership has sitting on its lot has long been a cornerstone of negotiating tactics, so where are savvy buyers apt to find the best deals based on bloated inventory? Reportedly, Chrysler, Dodge, and Lincoln are all sitting on inventory levels more than double the national average. In contrast, buyers of Honda, Lexus, and Toyota will find themselves vying with other customers over low inventory levels, according to Kelly Blue Book's latest data for 2024. The remainder of automakers find themselves somewhere in the middle, with an industry average of 80 days' supply of vehicles, the highest since early-2021. That's compared to pre-pandemic mid-2019 supply of 86 days worth of vehicles.

In summary, while new car prices are falling — some segments more than others — and inventory levels are normalizing, the effects of recently negotiated higher auto industry wages have yet to be felt on a widespread basis. Ditto for the Federal Reserve's "higher for longer" interest rate policy, which directly affects purchasing power via auto loan payment affordability. The former could lead to further car price inflation, while the latter may have the opposite effect. Finally, keep in mind that many personal finance gurus like Dave Ramsey and Suze Orman recommend against buying a new car altogether. Instead, they recommend seeking out a slightly used car, like one coming off-lease, and paying cash for it, if possible.