You May Want To Think Twice Before Buying A New Car

Let's face it, that "new car smell" can be a strong aphrodisiac. The factory-fresh scent — which mostly comes from the off-gassing of plastics, upholstery, and adhesives in the interior — is so popular that it's also available in the form of air-fresheners and spray bottles to duplicate the sensory experience in your own perhaps not-so-new car. As it turns out, hanging that Christmas Tree air freshener in a slightly used vehicle rather than splashing out for brand new one could be a very wise financial move.

According to data from the Black Book, a trade publication that tracks used car prices, the value of a new car declines 20% to 30% in the first year alone, then an additional 15% to 18% every year after that. Compounding the detriments of depreciation, most new car buyers borrow money for their purchase. These, along with other factors, can make buying a new car a bad financial decision in many circumstances.

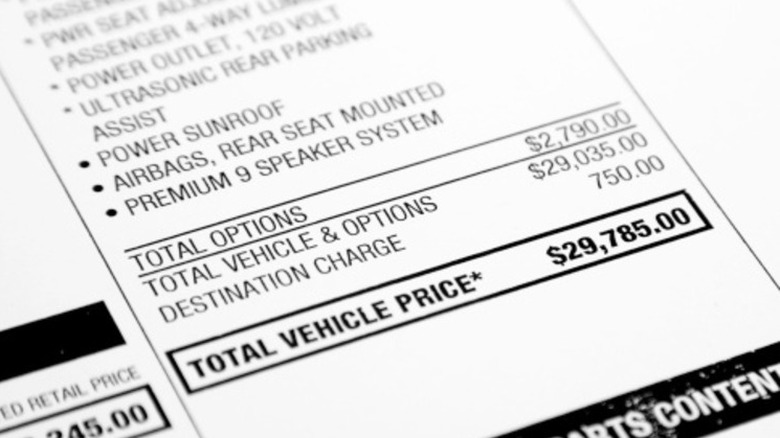

New car prices are stuck near all-time highs

Even though new car prices have fallen slightly from all-time highs, they're still stubbornly expensive. According to Kelley Blue Book, "The average new car buyer in America paid $48,334 in July [2023]." Even when luxury cars are factored out of the equation, the average non-luxury car costs a whopping $44,700. The only bright spot is that the price of new electric vehicles is falling, driven by Tesla's price-cutting strategy and the pressure for other automakers to follow suit. In July 2023, the average EV price paid was $53,469, down from more than $61,000 at the beginning of the year.

New car inflation — much like every form of inflation right now — might be leveling off or declining, but the damage has already been done. Unless we get deflation, new car prices will remain stubbornly high and the recent United Auto Workers strike certainly isn't going to help. Even if the UAW's demands aren't fully met, higher wages of some magnitude are on the way for some manufacturers, keeping pressure on new car prices.

Auto loan interest rates have also skyrocketed

In December 2021, the average interest rate for a 60-month auto loan hit a cyclical low of 3.85% according to Statista. Since then, it's been a moonshot with current September 2023 rates for the same 60-month term at 7.51%. For a consumer financing $40,000, that difference equates to a monthly payment of $801.71 versus a monthly payment of $733.96 at the lower rate.

On the surface, the approximately $70 per month difference in payment might not seem that significant, but over the life of the loan, it really adds up. Total interest paid at the 7.51% rate is a whopping $8,102.48 versus a total of $4,037.38 at a rate of 3.85%. So besides incurring an average price depreciation of up to 60% on that new car throughout the loan, you'll be throwing away over $8,000 in interest.

Playing devil's advocate for a moment, it's worth mentioning that some automakers will offer special low-interest-rate financing incentives to increase sales of a particular model. These lower-than-market-rate deals can close the gap somewhat between new and used, but don't overspend for a vehicle just to take advantage of a shiny low interest rate.

New cars depreciate quickly

In the old days, Detroit's "Big Three" automakers would change the styling of new vehicles every year or two to keep image-oriented buyers on the treadmill of owning the latest and greatest. Nowadays, product cycles are more like five to seven years with a modest mid-cycle refresh somewhere in the middle. Therefore, it's entirely possible to buy a two to three-year-old car that has already taken the largest depreciation hit, but with styling that's still similar — if not identical — to a brand-new model.

Once again referencing the Black Book that many car dealerships use to calculate trade-in values, the average new vehicle depreciates approximately 60% after five years of ownership. When a consumer borrows a significant portion of a vehicle's purchase price, that vehicle can lose value faster than the loan is being paid down, a situation that's commonly known as being "upside down" on your car loan.

That means you owe more on your vehicle than it's worth, so if you need to sell, the options would be paying the shortfall in cash or a mistake that many car buyers make: rolling the negative equity from your old car loan into a loan for the new vehicle, leading to an even more upside-down situation.

Buy lightly used instead

Nobody wants to break down or waste time and money constantly having a vehicle repaired. The inherent reliability of a new car offers a peace of mind that comes from having repairs covered by a manufacturer's warranty. But a great alternative exists in buying cars that were previously leased for a period of two or three years, then returned to the leasing company. In an interview with CNBC, financial author David Bach mentions, "Buy a car that's coming off of a two- to three-year lease, because that car is almost brand new and you can buy it at that 30 percent discount."

Because leases most often have mileage limitations of 10,000 to 15,000 miles per year, these vehicles aren't likely to have accumulated a ton of mileage. Better still, nearly every automaker offers some sort of Certified Pre-Owned (CPO) program to incentivize shoppers to purchase their off-lease vehicles. The CPO process typically includes a comprehensive mechanical inspection and vehicle history check.

CPO vehicles also come with a limited comprehensive "bumper-to-bumper" warranty as well as an extension to their powertrain warranty, which covers major components like the engine and transmission, frequently for seven years or more from the date when the vehicle was first sold or leased. Finally, even a non-CPO late-model used car will likely have a powertrain warranty of at least 5 years or 60,000 miles, giving you the confidence to save money by purchasing a gently used two to three-year-old vehicle.

Keep your current car or go without

With the advent of services like Uber, Lyft, and DoorDash, not to mention gigantic online retailers like Amazon, it's entirely possible to not own a car at all. There are a plethora of businesses willing to bring you just about anything from groceries to clothes to furniture, or drive you anywhere. Granted, those services aren't free and the fees can start to stack up, but so can fuel (or charging costs), insurance, and maintenance on a vehicle, initial purchase price notwithstanding. City dwellers with abundant public transportation may find it even easier to ditch car ownership and vehicles can always be rented for longer trips.

If you do prefer to own a vehicle, consider keeping your old one as long as possible. Reasonably modern cars can easily last over 100,000 miles with proper maintenance and the cost of insurance may be lower compared to a more expensive, newer model, as are the registration fees in certain states. There may be a point at which expensive repairs are required or a vehicle is no longer reliable or trustworthy enough for your needs and in that situation, a newer car may be wholly justifiable. In the meantime, resist the urge to keep up with the neighbors, who might be drowning in debt anyway under their flashy outward appearance.