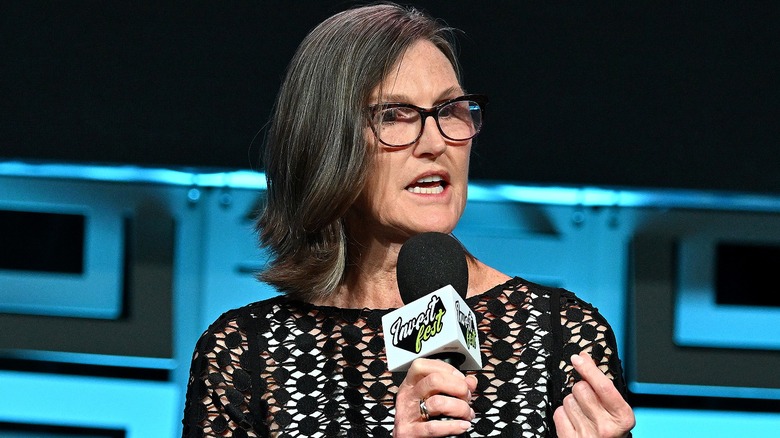

Investing Tips From Cathie Wood We Should Be Paying Closer Attention To

While taking the financial advice of talking heads, writers, celebrities, and businesspeople isn't always the best idea, some of them do offer unique expertise that could benefit your financial future. Enter Cathie Wood, a successful stock-picker and founder (and CEO and CIO) of the investment management firm ARK Invest (which currently has $60 billion in assets). Wood made a name for herself by investing heavily in what ARK refers to as "disruptive innovation" or new tech that will change existing markets. This includes things like self-driving cars (she's an avid supporter of Tesla) and even genomics and precision therapies to cure diseases. ARK estimates that the global equity market value associated with these disruptive innovations could increase from 16% of the total market to more than 60% by 2030.

ARK also predicts disruptive innovations are headed for big returns. For instance, it predicts that disruptive innovation's market capitalization could grow more than 11 times its current value to an estimated $220 trillion. While some of Wood's preferences, such as cryptocurrency, might not appeal to everyone (make sure you keep an eye out for the biggest crypto scams in 2024), other preferences like a push for electric vehicles could be more appealing. Regardless of your personal investment preferences, it ultimately can be worth listening to the advice of someone like Cathie Wood, who Bloomberg named the Best Stock Picker of 2020. Let's next explore some of Wood's most useful investing advice.

Advice for new investors

One particularly interesting piece of advice Wood gave as part of the Talks at GS (Goldman Sachs) series was, "I would say try and stay away from anything that is benchmark sensitive. I don't think that's where the real opportunity is. I think that world is being populated by value traps. And [...] I think the returns are going to be disappointing."

For those who might know, a benchmark in finance is a standard that's generally used to analyze everything from allocation to risk to return. A particularly famous benchmark would be the S&P 500 index, which is seen specifically as a benchmark for equities. While many investors generally use a market or combination of indexes with which to compare their own portfolio performance to, Wood instead suggests avoiding stocks that could be affected by and/or ultimately beholden to existing benchmark rules. This is in line with her own preference for stock selections, choosing disruptors over more tried-and-true options. (Speaking of the S&P 500, here's how often it rebalances.)

Wood also offered that you should "... try and associate yourself directly with some performance metrics," as well as explained that keeping these measures is important because "no one can take that away from you." As more and more companies, firms, and even technologies move toward needing concrete data on returns on investment (or ROIs), it can be crucial to keep that kind of data on hand not only for your own knowledge but also as a way to, essentially, prove your value to a company (especially if applying for a new role in the future).

Wood's specific investment interests

While Cathie Wood has a long history of backing new technologies, there are a few innovations she is a particularly avid investor in. More so, she's confident these innovations will lead to significant returns. For starters, despite public rockiness in many AI rollouts (here's looking at you Google), she believes that "every industry is going to be transformed by artificial intelligence." She even went so far as to say AI is "going to scale in 10 years to $80 trillion."

Biotech is another significant element of Wood's ARK Invest focus. "The convergence of DNA sequencing and artificial intelligence will be able to help doctors spot when a body is setting up to mutate," she explained. "[I]t would be amazing to head that off at the pass." Per its research for 2023, ARK Invest forecasts these companies focused on precision therapies could grow by 28% annually over the next seven years. If so, that would bring their total value to an estimated $4.5 trillion by 2030. AI definitely made an impact on 2023's best-performing stocks.

She also offered that investors should remember to, "just be willing to be adventurous. And when others are running away and it's conventional wisdom that something is not going to take off, take a closer look at it. And see if you can find any merit. I'm not saying there will always be. But if there is merit as others are dismissing the possibilities, that's where you're going to find great success."