Can You Deduct Gambling Losses On Your Taxes?

Given that nearly 90% of taxpayers take the standard deduction on their returns, per the IRS, you might not have given much thought to itemizing your deductions in recent years. For this reason, you also may not know about some overlooked tax deductions, such as charitable donations and money lost from gambling. That's right, you can deduct gambling losses on your taxes.

As with any other itemized deduction, you'll just need to list your gambling losses on Schedule A; specifically, line 16, "Other Itemized Deductions." When it comes to gambling losses, however, keep in mind that you're limited as to how much you can deduct. Whether it's slots, sports betting, bingo, or the lottery, you can't claim more gambling losses than winnings. If you won more than you loss, the difference will remain part of your taxable income.

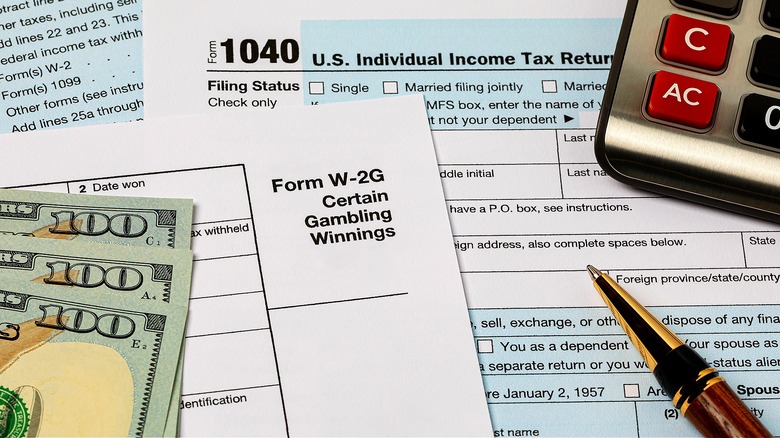

As for gambling winnings, note that this includes money and noncash winnings, like a car or a trip. The IRS requires you report any winnings as "other income" on your tax return, even if it wasn't high enough to trigger a Form W-2G, Certain Gambling Winnings. For your gambling activity, keep good records throughout the year, along with your receipts and any other documentation that'll be able to verify dates and amounts.

Gambling winnings, losses, and taxes

From that $20 winning scratcher to the trip you won at your company's year-end raffle, you need to report to the IRS the total cash value of how much you won for the entire year. In some cases, if your gambling winnings are high enough, you'll receive a Form W-2G, which reports your winnings and which gambling institutions are required to issue if winnings top a certain amount. The threshold to trigger a W-2G varies by game; for example, for slots, a person needs to win $1,200 or more.

If you do receive a W-2G, 24% of your winnings will already be withheld to pay for federal taxes. Note that whether or not you still owe the IRS on your W-2G winnings once you file your return depends on what tax bracket you're in. There are seven tax brackets (i.e., tax rates) in the federal tax system, and 24% is right in the middle: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. For tax year 2023, the income ranges for the 24% tax bracket are $95,376 to $182,100 (heads of household start at $95,351) and $190,751 to $364,200 for married couples filing jointly. If your taxable income is above this range, then you'll owe; if it's below, you could get a refund back.

As for your taxable income, deducting gambling losses will help lower it. But, remember, you can only deduct up to your winnings. So, reporting exactly how much you won is 1) required and 2) sets the bar for how much you can deduct in gambling losses when you itemize your return.

Deducting your gambling losses

You can only deduct gambling losses for the year by claiming it as an itemized deduction on your return. If you take the standard deduction instead, you can't tack on your gambling losses. You have to choose one or the other. Further, as said, when it comes to gambling losses, you're limited to what you won. For example, say you won $200 during the year but in your efforts to win $200, you lost $2,000. When it comes time to file your taxes, you report the $200 you won as "other income" on Form 1040, and you claim $200 on Schedule A — the $1,800 difference is not deductible. For this reason, it may not be worth it to itemize the loss, if taking the standard deduction will reduce your taxable income by more.

This said, you won't really know this until it's tax season and you're ready to file, which is why you should keep good records for the entire year if/when you gamble, just in case you do want to itemize your gambling losses, along with any other deductions (like your mortgage and/or donations). And, it should be noted you can't take it upon yourself to deduct the wager amount from your winnings. For example, if you won $500 on a $50 Super Bowl bet, you need to report $500 to the IRS, not $450.