Dave Ramsey Says You Should Avoid This Type Of Life Insurance

Whole life insurance, as the name implies, provides coverage for the insured's entire life. However, aside from paying a predetermined death benefit — a primary function of all life insurance policies — whole life insurance also has an interest-bearing savings component, known as "cash value." On the surface, whole life insurance can seem like an attractive proposition, but it's one of personal finance expert Dave Ramsey's most hated products.

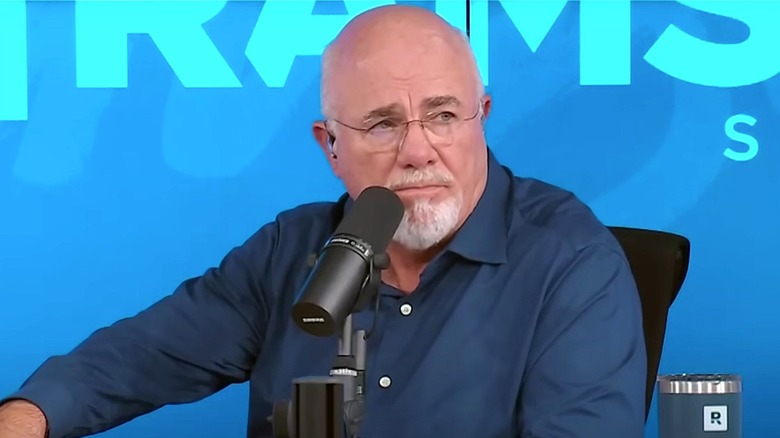

For those unfamiliar with Dave Ramsey, he's a bestselling author and host of a syndicated radio show. After declaring bankruptcy early in life, Ramsey has since turned his fortunes around (pun intended) to the tune of a $200 million net worth. So what are his nitpicks with whole life insurance? To start, it's much more expensive than term life insurance — up to 20 times more expensive every month, per Ramsey. It's the primary reason why insurance agents push whole life insurance on unsuspecting customers: the sales commissions are massive.

Unlike term life insurance, which lasts a certain number of years and must be renewed periodically, whole life insurance is a one-time "set it and forget it" proposition. That's undoubtedly convenient to policyholders, but the tradeoffs are many. Besides pricey premiums, let's take a look at some other downsides.

You can get better rate of returns elsewhere

The savings account portion of a whole life insurance policy, the "cash value," grows quite slowly over time by virtue of a low interest rate. That's because the policyholders are at the mercy of the insurance company's investment decisions, which tend to be quite conservative and lag the major stock market indexes. For many consumers, the lofty premiums that whole life policies charge would be better invested in conventional retirement plans like an IRA or 401(k) account, where the funds can be invested at the preference of you or your financial adviser.

As Dave Ramsey explained, for every $100 paid in premium on a whole life policy, $5 pays for the insurance — the same amount you'd pay for a 15- or 20-year term life policy. The remaining $95 is the cash value, and he says in the first three years, this pays for fees only. Said Ramsey, "The second thing is that once you do start building it, nationally ... the average rate of return on the $95, if you look at your actual cash-value buildup — including the three years of zeroes on the front end — it ends up being an average of about 1.2%."

This said, once you've accumulated some savings in a whole life account, you can either borrow against those funds, withdraw a portion, or else leave them be. Unfortunately, none of these options are particularly attractive.

Accessing the policy's funds is not easy

Let's start with the most outlandish concept of being able to withdraw your money from the cash value on a whole life policy. That can only happen once the policyholder has reached "maturity age." While maturity age varies by insurance company, it's most commonly pegged at 120 years old. Needless to say, planning to live to 120 in order to access your savings isn't an ideal investment strategy.

Borrowing against the funds isn't much better. One, you'll have to pay interest in order to borrow your own money, though the rate can be lower than other types of personal loans. Additionally, if the funds aren't repaid by the time of the insured's death, the loan amount will be deducted from the death benefit. Perhaps the worst possible outcome, however, is when a policyholder leaves the cash value untouched. At the time of the insured's death, the beneficiaries will receive the death benefit amount, but the insurance company keeps the cash value the insured saved into all those years.

And for Dave Ramsey, that's the most despicable part about whole life insurance ("It's not a mild dislike," he said on his radio show. "I hate it."). In theory, beneficiaries can choose the receive the cash value instead of the death benefit amount, but, since the death benefit is often $1 million or more, it's likely the cash value will be smaller, thus forfeited. Consumers should be aware that whole life insurance is sold under different names, including universal life, final expense, and group life.