Think Twice Before Taking Out A Payday Loan. Here's Why

Inflation, housing costs, and the restart of student loan payments have left many Americans today feeling cash-strapped and strained. For those with bad credit, or without a bank account, it can feel impossible to get by — even if you just need a little extra short-term financial help. Enter payday loans, a type of short-term cash advance that generally serves as a holdover until a borrower's next paycheck (or pension, Social Security, etc.). These short-term loans generally have fast turnaround times on repayment and come with hefty interest rates and fees. However, despite these negatives, they can oftentimes be the only option for financially vulnerable Americans trying to get by.

According to a series of reports by the Pew Charitable Trusts in the early mid-2010s, 12 million Americans at the time used payday loans every year. On average, these borrowers took out eight loans a year, each averaging $375. On top of this, the nonprofit found that borrowers would spend around $520 on the interest for these loans. Interestingly, despite the long-held belief that payday loans are used for unexpected emergencies, Pew found that 69% of borrowers actually used their payday loans to cover recurring expenses like rent and utilities.

The lack of regulation over payday loans, combined with predatory and questionable business practices on the part of payday lenders has led to a booming industry that often profits off of the financial misfortune of vulnerable Americans. While the short-term nature of these loans might seem like a quick and easy way to avoid missing payments on other expenses in your life, they are not worth the financial penalties or dangerous consequences that can come from using them.

You'll pay exorbitant interest rates and fees

Most payday loans carry annual percentage rates (APR) of at least 300%, but as the Consumer Financial Protection Bureau notes, a $15 fee for every $100 would equal a 400% APR, and now consider what this would be for the average $375 loan. This isn't only excessive but predatory for low-income borrowers who generally need short-term loans the most.

It's important to know that most states in the U.S. do not have consumer protections when it comes to payday loans, which is what allows lenders to mandate these financially unreasonable rates. Plus, payday loan lenders also set up nearly impossible loan requirements like single-lump sum repayment on loans. In fact, 22 states allow payday lenders to mandate short-term loans be repaid all at once. According to data from the Pew Charitable Trusts, these states also have average payday loan interest rates as high as 652%.

Thirty-one states, meanwhile, currently allow high-cost payday lending, but the worst thing is just how many of these states have failed to close loopholes that would allow for better regulation. For instance, even though Virginia requires loans to be payable across two pay cycles, lenders found a way to restructure their loans as open-end lines of credit in order to evade state-mandated consumer protections.

Similarly, Ohio voted to cap payday loan rates in 2008, but lenders simply switched the laws they operated under in order to circumvent the will of the voters, and the Ohio legislature failed to correct the loophole. So, despite the absurd interest rates attached to payday loans, and even the will of voters to try and correct it, lenders are operating freely in most U.S. states.

You could get trapped in a debt cycle

Perhaps the worst part of payday loans is how likely borrowers are to continue needing them once they've started. Between the fees and the slim margins of the incomes of those most likely to need payday loans, the chances of taking out even more payday loans to pay off the first (or second) are high. This can and does create a cycle of debt that can make it extremely difficult to get out of. The Consumer Financial Protection Bureau found that almost 70% of payday loan borrowers end up taking out a second payday loan within a month of their first. Even worse, one in five payday loan borrowers will end up taking 10 (or more) payday loans in a row before they're able to fully repay their debt. These borrowers will take on even more fees and interest on their preexisting debt with each successive new loan, inflating the amount they'll end up having to pay.

According to the Center for American Progress, the people most likely to take on a payday loan are also some of the most financially vulnerable. Most don't have a college degree, are renters, and earn less than $40,000 a year. This makes the predatory nature of payday loan terms and fees even more difficult for borrowers to navigate, while also making these borrowers far more likely to fall into a cycle of long-term debt. In pursuing new loans to pay off their old debt, borrowers can inadvertently create a financial black hole.

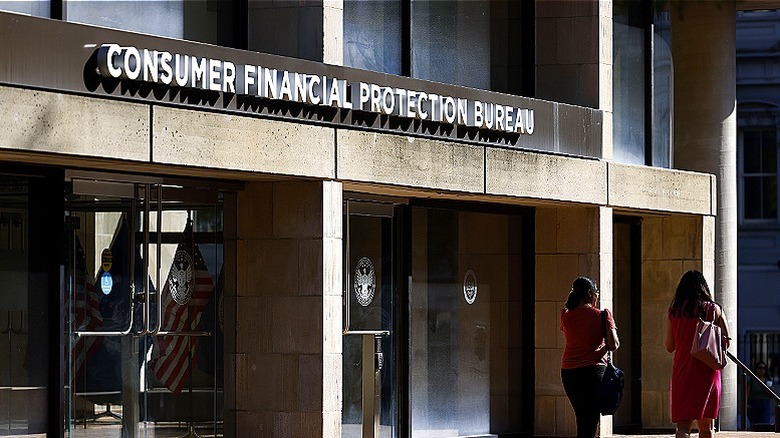

Regulation might not be coming soon

As of this writing, the Consumer Financial Protection Bureau has received more than 30,500 complaints regarding the unethical tactics used by payday loan issuers. Predatory behaviors from lenders the CFPB has targeted have included overcharging military service members, aggressive refinancing tactics for financially vulnerable borrowers, and taking money out of people's bank accounts without authorization. However, it's important to realize that many of these payday loan firms have managed to successfully block numerous federal investigations into their business practices.

To make matters worse, many of the firms that were the targets of CFPB-led regulatory attempts, fines, and refunds have attempted to dismantle the federal agency rather than change their practices. Specifically, a corporate trade association composed of payday lenders sued the CFPB in 2018, claiming the bureau is unconstitutional due to its independent funding structure (it's funded through the Federal Reserve). The Supreme Court heard arguments for this case in October 2023 and is expected to release its ruling in spring 2024.

In the meantime, payday loan companies are using the current uncertainty of this case as a way to delay and even avoid punishments and/or fines for predatory practices. Since the CFPB is the only body currently attempting to add regulatory practices to benefit financially vulnerable people, the Supreme Court's decision could have a huge impact on just how unchecked the payday loan industry can continue to operate. Borrowers could face even fewer protections and rights than they already have, which would lead even more Americans to detrimental financial results.