Don't Believe This Credit Card Myth That's Hurting Your Credit Score

When it comes to your credit score, there are a LOT of supposed tips, tricks, and myths designed to help you improve your number. While some of these tips can be beneficial and downright responsible (like avoiding missing a credit card payment), not all of these myths are beneficial to your financial health. One such myth is the idea that carrying a balance on your credit card(s) will help your credit score. Not only is this myth not true, but it can actually end up hurting your credit score while also costing you a lot of money.

According to Forbes, the current average credit card interest rate is 27.8%. This means that even if you only carry a small balance over to the following month of your credit card statement, you'll be paying quite a bit in interest. With that in mind, even if the annual percentage rate (APR) of your specific credit card is less than the national average, this added interest can add up from month to month.

Added interest also has the potential to snowball into larger debt amounts that make it more difficult to pay off your balances. Since the interest rate on credit card balances is compounded and accumulates daily, you'll pay for every single day past the due date you carry that balance. Ultimately, added interest ensures you're paying off debt for even longer, which can have ripple effects across your finances.

The myth of carrying credit card balances

Keeping a balance ensures you're spending more money on the things you've already purchased because of the added interest that'll be added to the total purchase amount. However, that isn't the only way carrying a balance can financially hurt you. Despite the myth that carrying a balance can improve your credit score, the truth is actually the opposite. Carrying a balance on your credit card has the potential to negatively impact your overall credit by affecting multiple different categories within your credit score, including amounts owed, credit utilization, and payment history.

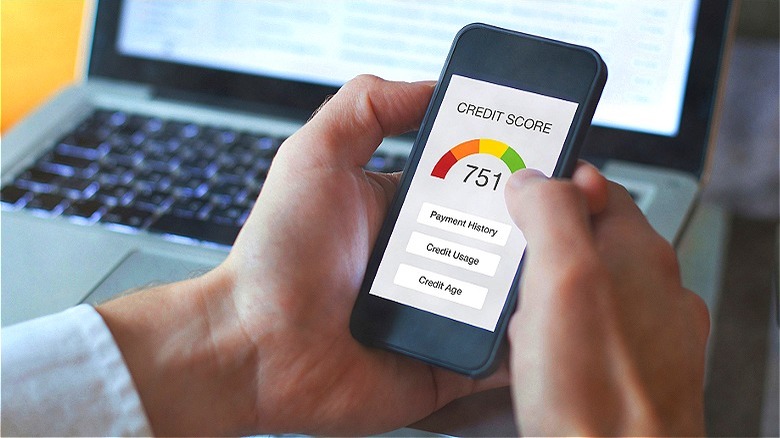

According to the Consumer Financial Protection Bureau, paying off your entire credit card balance every month is actually the best way to improve your credit score. This is mainly because paying the balance off ensures you keep your credit utilization ratio low. Your credit utilization ratio is the amount of credit you have available to you compared to the amount you've already used/spent (divide your credit card balance by your credit card limit if you want to know what your ratio is).

This also relates to your amounts owed, since using a lot of your available credit can make banks assume you're a higher risk. Lenders generally want a ratio below 30%, so it's important to avoid keeping a credit card balance that might affect this ratio. This can be especially true if you're looking to get a loan, rent an apartment, or apply for a new credit card anytime soon.

Other ways to improve your credit score

There are plenty of other easy ways to improve your credit score that don't involve paying interest. For starters, paying on time can make a huge difference to your overall credit, especially if you keep the practice up long term. Payment history is a significant factor in determining your credit score, so ensuring your history remains blemish-free can make a huge difference to your credit report.

The length of your credit can also be an important factor in determining your credit score, so keeping a credit card account long term can actually help to boost your overall credit, even if you don't use it all that frequently. Similarly, make sure to avoid opening multiple new lines of credit in a short period of time since this can signal you're a potential financial risk.

Another way to help your credit score is to ensure you have a healthy credit mix. A credit mix involves having different forms of credit accounts (both revolving and installment) to better showcase your ability to handle different kinds of credit. Revolving accounts include credit and retail cards while installment accounts are things like mortgages, auto, and student loans. Having only one or the other fails to give creditors insight into how responsibly you might handle different kinds of credit. Since credit scores are ultimately an assessment of your creditworthiness, showcasing your ability to handle multiple kinds of financial categories can make you more appealing to potential lenders.