FTX Explained: What Is It And Why Did It Collapse?

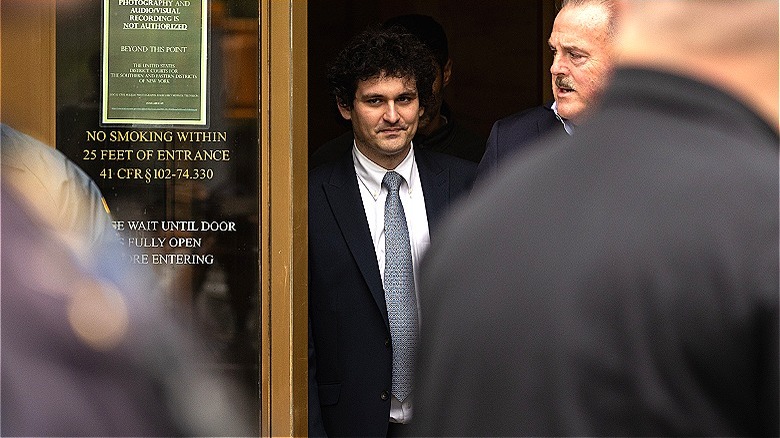

The FTX saga seems to be coming to a close. With the hammer blow of guilty verdicts coming back in just over four hours of jury deliberation, Sam Bankman-Fried, the progenitor of the FTX cryptocurrency exchange, now faces decades behind bars. His crypto empire, once valued at $32 billion, has come crashing down in a spectacular meltdown that took just days to complete. It's, therefore, not surprising that many of the details of the gigantic fraud that FTX ultimately became have been hidden under a mountain of new reporting on Bankman-Fried's trial, the personality that he is (sometimes referred to as SBF), and on what his future may hold.

Cryptocurrency is by nature a bit of a murky financial space, with regulations still lagging far behind those of the more established marketplace commodities (like stocks, for instance). But SBF's crypto voyage is actually somewhat more straightforward than it might initially seem: The MIT graduate ended up at the New York trading firm Jane Street out of college and eventually set out on his own path to commodity trading success. This is the story of FTX, its creator, and the truly epic downfall of both, which United States Attorney Damien Williams called (via press release) "one of the biggest financial frauds in American History — a multibillion-dollar scheme to make him [SBF] the King of Crypto."

FTX only launched in 2019

The path that led to the indictment and a forthcoming prison sentence for FTX's founder, Sam Bankman-Fried, began years ago, but the company itself was only founded in 2019. The platform and its app offered a welcoming environment, and both experienced investors and those new to the cryptocurrency market alike flocked to the trading space.

It's notable that FTX was such a young exchange, however. Within cryptocurrency markets, reputation and reliability are key facets in selecting a platform to facilitate trading. These are features that can only be built through years of trust, leading to significant user preference for older, well-established exchange platforms like Coinbase (2012), Gemini (2015), and Bitstamp (2011), the first exchange created. Another feature of Coinbase, in particular, is its status as a publicly traded company. This means the brand can't engage in roguish behavior that might otherwise thrive in the regulation abyss of cryptocurrencies (and certainly did at FTX).

The exchange served millions of users

Even with its lack of historical precedence in the marketplace, the FTX exchange quickly gained a sizeable following. At peak, the exchange served 1.2 million American crypto traders and savers. This isn't in the same league as the likes of Binance, with 128 million users, or Coinbase, with 108 million, but places it in the same general conversation as other household names in the industry like Kraken (around 4 million users in 2019) or CEX.io with about 3 million users.

Moreover, when the company went belly up, the 1.2 million users in the U.S. (and around 5 million around the world) represented a substantial number of investors who had put some or perhaps even all of their savings for the future into the vision sold by Sam Bankman-Fried and his team. It's easy to see why; FTX appealed to the early entrant into the crypto world with support for nine prominent fiat currencies, including the U.S. Dollar, Pound, Euro, and even the Ghanian Cedi. Traders could utilize leveraged trading to take advantage of token ownership, futures trading, and a variety of other actions within the cryptocurrency space. FTX made it easy to get into the cryptocurrency game, and many bought in as a result.

Before FTX, Sam Bankman-Fried started Alameda Research

Before his cryptocurrency exchange was even a thought in Sam Bankman-Fried's calculations, he was trading what is known as the Kimchi swap. In 2017, he became aware of the fact that different exchanges posted their own spread rates on Bitcoin and other crypto assets. These unique rates were sometimes as far off as around 60% across different exchanges, with those located in South Korea showcasing a particular discrepancy in the value of a cryptocurrency (hence the nickname).

The act of arbitrage trading wasn't difficult, but it took a keen eye for pricing gulfs and a good bit of legwork. Bankman-Fried turned out to be a natural at the task, though, and launched Alameda Research to further the project after only a month. The firm tasked itself with creating processes to streamline these trades, and his team reportedly hit $1 million in earnings per day quite often. Alameda was formed in late 2017. However, over time, margins became slimmer in the arbitrage game, and the business relied on leverage that stemmed from crypto loans and other forms of fiat investment into the brand.

By 2019, Sam Bankman-Fried ostensibly settled on a new means of funding his trading venture: A crypto exchange that his business could rely on as a constantly willing lender. FTX was born, tethered indiscriminately to the Alameda name as two sides of the same coin, unbeknownst to personal investors who bought into the new exchange.

FTX's marketing blitz

After launching the crypto platform, Sam Bankman-Fried and company departed on a vast marketing blitz that would underpin much of the rapid growth experienced by the exchange. FTX bought the naming rights to the Miami Heat's home arena, purchased a Super Bowl ad, and partnered with celebrities, like Tom Brady and Kevin O'Leary of "Shark Tank" (who was paid $15 million by the firm to promote its business). In Japan, FTX logos could be seen on billboards next to Shohei Ohtani, the generational baseball talent whose transcendence is legitimately compared to that of Babe Ruth in conversation and analysis.

FTX's marketing assault was obviously intended to attract customers to its platform. But in hindsight, it might seem the company's ultimate goal was to pull an end run on the necessity of constantly pitching institutional investors on the Alameda front. Users got a well-built trading platform, but it seems now the convenience of a flashy crypto exchange came at a significant cost.

Bitcoin's price retraction in late 2021

The dual companies operated an open door with one another when it came to funding. Sam Bankman-Fried claimed this pooling of resources wasn't intentional, but the evidence truly speaks for itself. Ponzi schemes and their ilk inevitably run into an unmanageable situation that causes them to unravel, and it seems two specific events led to FTX's collapse. This pulling of the thread likely began in late 2021 when Bitcoin's value plunged. It was then decimated in early 2022, when TerraUSD collapsed, taking more than $400 billion in crypto market capitalization with it. TerraUSD has been likened to a Ponzi scheme itself, and its demise further deepened an already reeling cryptocurrency marketplace.

During this challenging time, one in which Bitcoin fell from a peak of over $68,000 to around $18,000, FTX signaled unflappable strength while its competitors shriveled and resorted to more bear market-style tactics. FTX's behavior, during what was deemed a "crypto winter," cut sharply against the grain. It's perhaps the company's continued efforts to reach ever higher while others in the marketplace opted for security-minded strategies that ultimately led FTX over the cliff.

FTX lent $8 billion to sister company

Among the charges brought against Sam Bankman-Fried was the finding that his early startup, Alameda Research, had been siphoning assets from FTX accounts, virtually from jump. The two companies were linked together, and a free flow of capital was allowed between the two — with assets primarily flowing in one direction. FTX funded Alameda's trading efforts to the tune of $8 billion, capital drained directly from client accounts rather than any profits that the company had generated. The result was an elaborate scheme to prop up Alameda's trading at the expense of the millions of people who had invested their money with FTX.

In addition to serving as Alameda Research's personal piggy bank, client funds at FTX helped pay for what has been described as a Bahamian "real estate empire" as Bankman-Fried seemingly worked to convert his crypto wealth into a more tangible one. He also siphoned off funds to pay a $40 million bribe to Chinese officials in an effort to unfreeze Alameda accounts. This has led prosecutors to levy additional charges against the FTX founder, with another trial set to begin in March 2024.

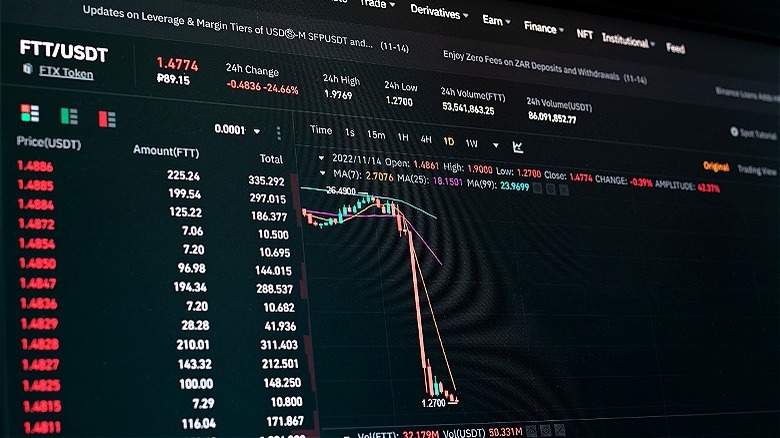

CoinDesk blew the lid off the FTX scandal

On November 2, 2022, CoinDesk published balance sheets from Alameda Research alongside analysis that clearly showed the merging of assets between the two brands. "Even though they are two separate businesses, the division breaks down in one key place: on Alameda's balance sheet," Ian Allison's blockbuster reporting notes (via CoinDesk). During Sam Bankman-Fried's trial, it came out that on the 6th of November, he pushed out an internal memo blaming Binance — a company that offered to buy FTX to stabilize the market in the days after the bombshell dropped but later backed out.

The initial take on Alameda's finances was that it existed financially on a house of cards. Built substantially on debt (that it actually owed to FTX) and the FTX exchange's own token FTT, including "FTT collateral," it quickly became clear that something unsavory was afoot between the two Bankman-Fried-owned brands. From here, a firestorm began that would unravel the threads holding both together, and with them the vast majority of Bankman-Fried's personal finances. Reporting suggests the FTX founder lost 94% of his wealth in just one day, the most substantial personal collapse ever recorded.

A victims' fund for affected customers?

FTX filed for bankruptcy on November 11, 2022, just days after the implosion of the company and its partner in Alameda Research began. The bankruptcy proceedings will see the government seek to take control of the companies' assets in an effort to return stolen funds to customers who used the exchange.

The best recourse that most victims will have when seeking to get their money returned is through the victims' fund that will assuredly be established in the coming months. In addition to government stewardship over company assets through the bankruptcy process, the Justice Department will conduct its own efforts to strip Sam Bankman-Fried and his compatriots of their ill-gotten gains.

It's already been announced that three cooperating witnesses have agreed to forfeit their proceeds from work conducted with FTX and Alameda Research. Nishad Singh, the exchange's chief engineer, for instance, is forfeiting a home he purchased in Washington and his investment (at the time worth $40 million) in Anthropic PBC, an AI company. These and other seized assets will eventually be pooled into a victims' fund that seeks to make affected clients as whole as possible. Patience will be frustratingly necessary, though. These things can take years to work out, unfortunately.

The prison sentence for FTX's disgraced founder

Sam Bankman-Fried was found guilty on all seven charges brought against him. These included wire fraud, securities fraud, and money laundering. If given the maximum term possible, the FTX founder is looking at a stint in the can lasting a whopping 110 years!

Among the details jurors heard during the trial were the revelations that after CoinDesk's reporting, customers started frantically trying to withdraw their funds from the FTX platform. In the days that followed, Bankman-Fried made a considerable effort to find a new source of funding, likely seeking to draw another entity into the nexus of his Ponzi scheme. During the trial, Bankman-Fried and his legal team sought to portray him not as a manipulative thief, but rather as a dreamer who had been caught up in the explosive growth of his paired companies and simply mismanaged the financials. The fact that "I can't recall" crossed his lips 140 times throughout his time on the stand certainly didn't help sell this alternative narrative, however.

Bankman-Fried isn't the only FTX personality facing prison

Sam Bankman-Fried's conviction and news of a new, pending trial to adjudicate further criminal activity by the FTX and Alameda founder aren't the final chapters of this short-lived but immensely destructive saga. Not only have the executives at Alameda and FTX decimated confidence in the cryptocurrency marketplace, perhaps for many years to come, but SBF's co-conspirators are also facing substantial prison time, too.

In addition to Bankman-Fried, who will learn the details of his imprisonment on March 28, 2024, Alameda CEO Caroline Ellison; FTX co-founder Gary Wang; and Nishad Singh, FTX's former engineering chief, are all on the hot seat. Ellison in particular faces significant potential penalties. As the chief executive of the other corporate half of this grift, and Bankman-Fried's ex-girlfriend, she's in a uniquely vulnerable position. All three, including Ellison, opted to cooperate with the government in its pursuit of Bankman-Fried, however, and therefore are likely looking at reduced sentences of some variety.

This leaves the cryptocurrency marketplace in a bizarre position, too. Bitcoin, for example, lost 65% of its value last year as the marketplace continued reeling in the wake of collapse after collapse (including FTX's). This wasn't the first scam in the crypto space, with rug pulls like Anubis Dao and Thodex pilfering billions in assets from investors, and it certainly won't be the last. However, Bitcoin and the market as a whole look to be slowly recovering, in spite of the bad faith actors who have become infamous in the space.